Ever wondered where financial opportunity meets innovation in the world of investments? Well, look no further than MLM stock.

If you are a newbie to the term “MLM stock”, let me make it clear to you. MLM stock refers to ownership shares in MLM companies using a direct selling model. Distributors in this model sell products or services directly to consumers, while also recruiting others, thus influencing the stock’s value. Interested to explore more? Let us take a closer look at direct selling stocks and explain why they’re such an attractive investment option.

Fundamentals of MLM Stock

MLM stocks are a great option for a reliable investment that will enable you to build up wealth over time. These equities are a great complement to any investor’s portfolio due to their reputation for stability and growth potential.

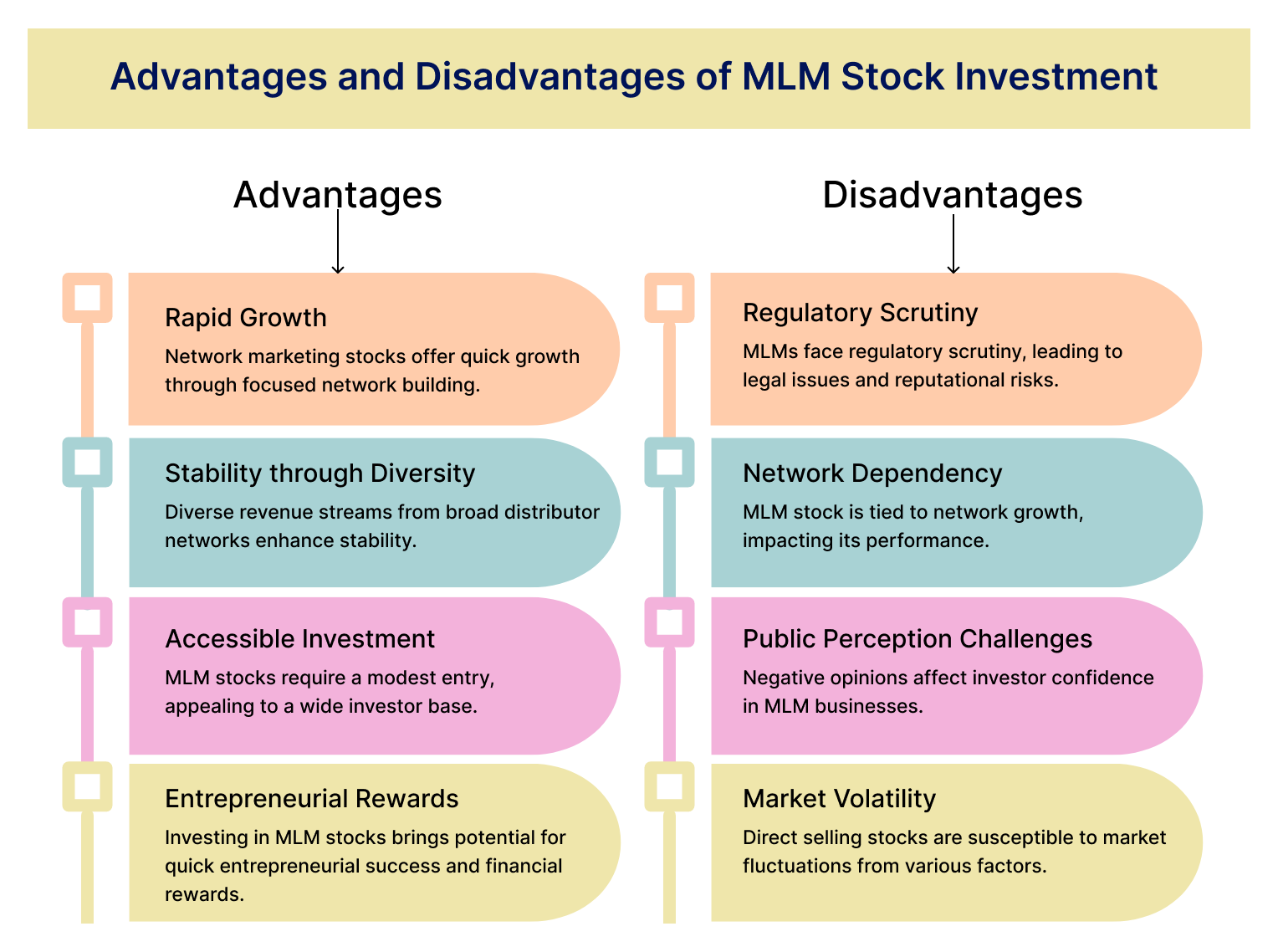

Here are some of the reasons why MLM stocks are a good investment:

- They have a track record of steady growth and stability.

- Compared to some other stock kinds, they are more predictable.

- They have the capacity to yield substantial profits.

- They are a useful method for portfolio diversification.

Transformation of MLM Stock Over Time

Network marketing stock has experienced a number of swings since its first public offering. Thus, it has been impacted by changes in the regulatory framework, market conditions, and the company’s strategic choices.

Here are some key milestones in the transformation of MLM stock over time:

Global MLM Expansion

The 1990s saw a significant surge in the worldwide growth of MLM networks, leading to an increased international presence of MLM companies. With the opening of new markets and the diversification of revenue sources, MLM stock gained prominence in the investing world.

MLM Tax Strategies

In the early 2000s, MLM companies began implementing effective tax strategies that not only optimized their financial performance but also reassured investors about the stability and sustainability of their business models. These strategies helped enhance the overall appeal of direct selling stock as a viable investment option.

MLM Resiliency

During the economic downturn of the late 2000s, MLM companies exhibited exceptional resilience, surpassing many other industries. This resilience underscored the stability and adaptability of MLM business models. Hence, this solidified the perception of MLM stock as a reliable investment choice even during challenging economic times in direct selling.

Regulatory Adaptations

Early in the new millennium, the MLM business saw regulatory changes that aided in fostering confidence with both regulators and investors. These changes included greater transparency and compliance requirements. The legitimacy of MLM businesses and the stocks they are linked to was enhanced by these modifications.

Technological Advancements

In the middle of the decade, MLM operations began to incorporate digital platforms and cutting-edge technology. This improved distributor experiences and expedited business procedures. This adoption of innovative technologies in direct selling further boosted the appeal of MLM stocks among investors seeking exposure to companies embracing digital transformation.

Recognition of Entrepreneurial Opportunities

In the late 2010s and early 2020s, the recognition of MLM as a platform for opportunities gained traction. This attracts a new wave of investors drawn to the prospect of financial success in MLM networks. This recognition contributed to network marketing stock’s appeal as a viable choice for investors looking for chances that are dynamic and self-driven.

Revenue, Sales Growth, and Profitability Ratios of MLM Companies

Gaining insight into the financial health and general success of direct selling companies requires analyzing their revenue, sales growth, and profitability ratios. By providing an overview of the essential financial indicators guiding these organizations, this review assists investors in making well-informed judgments.

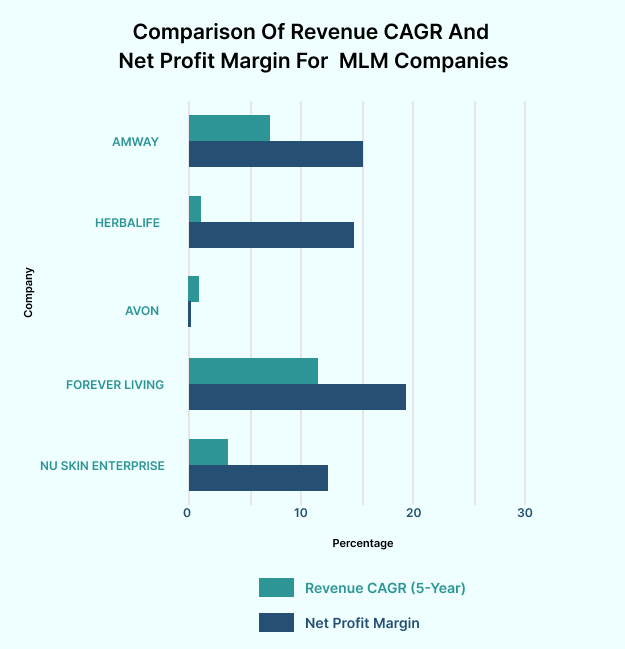

AMWAY

With a net profit margin of 10.5% and a 5-year sales CAGR of 7.4%, Amway has continuously demonstrated significant revenue growth and profitability.

HERBALIFE

With a 2.8% sales CAGR over the past five years, Herbalife’s revenue growth has been more restrained. With a net profit margin of 13.4%, profitability has remained robust.

AVON

Recent years have been difficult for Avon. During the previous five years, income has decreased by 2.2%. Therefore, a 0.9% net profit margin has put pressure on profitability as well.

FOREVER LIVING

A 5-year revenue CAGR of 12.1% indicates that Forever living has demonstrated robust revenue growth. Moreover, profitability has shown promise, with a 19.2% net profit margin.

NU SKIN ENTERPRISE

At a 3.6% revenue CAGR over the past five years, NU SKIN ENTERPRISE has experienced moderate revenue growth. The net profit margin has been consistent at 12.7%.

Statistical Insights into MLM Stock Performance

Evaluating the performance of MLM stocks requires a comprehensive analysis of various statistical indicators. As such, key performance indicators (KPIs) in direct selling provide valuable insights into the financial health, growth prospects, and market perception of MLM companies.

Let us look at the direct selling stock performance about each company in detail:

Amway offers stocks that represent ownership in the company. Thus, investors in Amway MLM stocks become part owners of the company’s global network of independent distributors.

The expansion of the distribution network and product sales both have an impact on the value of these stocks.

For individuals who are curious about the workings of network marketing and direct selling, Amway’s MLM stocks provide a distinctive method to invest.

Herbalife’s MLM stocks provide investors with a stake in the company’s unique MLM approach. The expansion of Herbalife’s global network of independent distributors and the sales of its nutritious products are directly linked to these stocks.

Herbalife’s MLM stock fluctuates according to how well the company is able to reach new customers and grow its product line.

Before thinking about buying these stocks, investors should keep a careful eye on Herbalife’s financial performance as well as the state of the MLM sector.

MLM stocks of Avon allows investors ownership in the form within the beauty and cosmetics industry. These stocks show the growth of Avon’s network of independent representatives in addition to the sales of its wide range of products.

Avon’s direct selling stock value is strongly correlated with its capacity to innovate in the cosmetics industry and draw and maintain a loyal base of customers.

When evaluating these companies, potential investors should take into account both Avon’s financial performance and the competitive environment of the beauty and personal care sector.

Forever Living’s MLM stocks offer investors a share in the company’s success within the health and wellness sector. The growth of their global network of independent distributors and the sales of its products based on aloe vera are closely related to these stocks.

The ability of Forever Living to uphold product quality, take advantage of wellness trends, and promote distributor growth all affect the value of the company’s direct selling stocks.

A thorough analysis of Forever Living’s financial standing and competitive strategies within the health and wellness industry is recommended for anyone contemplating investing in the company’s MLM stocks.

MLM stocks of Nu Skin afford investors a stake in the company’s unique position in the skincare and wellness industry. These equities are dependent on both the expansion of Nu Skin’s worldwide network of independent distributors and the sales of its cutting-edge products.

The value of Nu Skin’s network marketing stocks is significantly impacted by its potential to provide cutting-edge skincare treatments and expand its market reach. Effectively selecting and overseeing distributors is another important factor that affects the stock’s total worth.

Before evaluating these stocks, prospective investors should carefully examine Nu Skin’s financial record as well as the competitive environment in the beauty and wellness industry.

Strategies for Successful MLM Stock Investment

Effective strategies in relation to MLM stock investment lays out a crystal clear path to financial success. With well-researched insights and practical strategies, you can learn to manage the difficulties of network marketing stocks and pave the way for a profitable financial journey in the future.

Customer experience

Direct selling stocks are influenced by the quality of customer experience, a key factor in driving loyalty and business growth. Satisfied customers not only encourage brand loyalty but also play a major role in the long-term growth and profitability of direct selling stocks.

Marketing automation strategies

Increasing sales productivity, optimizing operations, and direct selling stocks all depend on the effective use of marketing automation techniques within the MLM industry. In addition to improving operational effectiveness, automated marketing procedures are essential for achieving the desired rise in sales that direct selling stocks aim for.

MLM training

Training programs in network marketing must be effective in order to shape a trained and motivated sales force. Know why? This in turn affects the success of direct selling stocks. One of the most important factors that directly affects the market performance and continuous success of direct selling stocks is a highly skilled and driven sales force.

In-Depth Research

Before making any investment in MLM companies, it’s essential to conduct thorough research. Analyze key aspects such as financial health, growth prospects, and leadership within each company. Look for companies that can close more MLM sales to ensure they have effective strategies in place for increasing sales.

Diversification

You can invest in a mix of companies offering different products and compensation plans. This strategy protects investments, minimizing losses if one company falters while others excel. In the volatile world of MLM stocks, a well-balanced portfolio maximizes long-term rewards and increases resiliency.

Stay Informed

Stay updated on industry trends and regulatory changes affecting MLM companies. Being well-informed about the latest lead generation ideas will give you a competitive edge in predicting which companies are likely to succeed, contributing to successful stock investments.

Trends and Forecasts: Projections for MLM Stock Growth

Amidst an era of economic shifts and technological advancements, our analysis unveils exciting forecasts for MLM stock growth. Explore the imminent trends set to redefine the industry and propel investment opportunities to higher levels.

Artificial Intelligence Integration

The use of artificial intelligence (AI) in MLM platforms is expected to enhance user engagement, personalization, and predictive analytics.

Algorithms powered by AI have the ability to enhance user behavior, optimize product recommendations, and enhance network performance, all of which can lead to higher stock growth for network marketing companies.

Blockchain Technology Adoption

The integration of blockchain technology within network marketing operations is projected to boost transparency, security, and trust within the network

Decentralized ledgers can improve the general integrity of multilevel marketing platforms, expedite transactions, and lower fraud. This may stimulate stock growth by boosting investor confidence.

Metaverse Expansion

The rise and spread of the metaverse offers direct selling companies fresh chances to investigate virtual marketplaces and interact with a worldwide clientele.

Best MLM companies can take advantage of creative sales methods by integrating metaverse technologies. Consequently, this boosts direct selling stock growth and satisfies customer needs by creating engaging brand experiences.

Reflection

MLM stocks stand out as a shining example in investment portfolios. They provide investors looking to accumulate wealth over the long term with stability and growth possibilities. Having said that, they are a worthwhile consideration for investors due to their stability and development potential, especially in light of the changing financial climate. As such, MLM stocks can play a strategic role in building a resilient and prosperous investment portfolio with careful consideration.

CAUTION

This blog is based on research from current available sources. Readers are advised to verify information independently and consult with financial professionals to ensure that their investment strategies align with their financial goals and risk tolerance.