Imagine being part of a business model where your success doesn’t just depend on your own efforts, but also on the team you build. That’s the essence of Multi-Level Marketing (MLM) in the insurance industry. In MLM business, your growth potential is amplified by the collective achievements of your network.

In a network marketing company, agents do more than just sell policies. They recruit others to join their network, creating a chain of professionals all working towards a common goal. Every policy sold by a recruited agent not only benefits them but also generates earnings for the person who brought them on board.

Did You Know?

As per a report,about 1 in 13 adults have participated in multilevel marketing.

Further in the blog, we will have a look at the top MLM insurance companies, challenges they face and much more.

Top MLM Insurance Companies 2026-An Overview

MLM insurance companies use a structure where agents earn money not just from selling insurance themselves, but also from sales made by the people they recruit. This system encourages agents to build and lead their own teams, helping the company reach more customers.

Here’s the overview of the top MLM insurance companies :

1. Utility Warehouse – Telecom Plus

Utility Warehouse, operated by Telecom Plus, is a UK-based MLM company that offers a unique range of essential services under one roof, including energy, broadband, mobile, and insurance. Founded in 2002, the company aims to simplify the lives of its customers by bundling multiple utility services into a single monthly bill.

Achivements:

- Revenue for 2023: £2,990 million

- Utility Warehouse is known for its innovative approach, becoming one of the fastest-growing companies in the UK utility sector.

- The company has won numerous awards for customer service and value for money.

- It has consistently grown its customer base and expanded its service offerings, becoming a major player in the UK’s utility market.

- Growth rate – Full-Year results for FY23 shows customer growth of 22%

2. Primerica

Primerica, based in the USA, is one of the largest insurance MLM companies operating within the MLM framework. Founded in 1977, Primerica focuses on providing term life insurance, mutual funds, annuities, and other financial products to middle-income families. The company’s mission is to help families become financially independent.

Achivements:

- Revenue for 2023: $2,810 million

- Primerica went public in 2010, and its shares are traded on the New York Stock Exchange under the ticker symbol “PRI.”

- The company has built a large network of independent representatives across North America.

- Primerica has helped millions of families secure affordable life insurance and build long-term financial security.

- For the quarter ended December 31, 2023, the company reported a 6% increase in total revenues,compared to the same period in 2022. Net income rose by 4%,, while earnings per diluted share grew by 9%, This reflects a positive growth trend across key financial metrics compared to the prior year.

3. World Financial Group

World Financial Group (WFG), founded in 2001 and headquartered in the USA, operates as a financial services marketing organization. The company provides a range of financial products, including insurance, investment, and retirement planning, with a focus on educating families about financial literacy.

Achievements:

- Revenue for 2023: $1,300 million

- WFG is a subsidiary of Transamerica, one of the largest insurance and financial services companies in the world.

- The company has expanded its reach across North America, empowering agents to help clients achieve their financial goals.

- WFG is known for its educational approach to financial services, aiming to increase financial literacy among its clients.

4. Family First Life

Family First Life, founded in 2013 and based in the USA, is an insurance MLM company specializing in life insurance, final expense insurance, and annuities. The company prides itself on providing high compensation and training for its agents, enabling them to offer comprehensive insurance solutions to families.

Achievements:

- Revenue for 2023: $503 million

- Family First Life has rapidly grown its agent network, becoming a significant player in the life insurance industry.

- The company is recognized for its high commission rates and agent-centric approach, which has attracted thousands of agents across the USA.

- Family First Life has helped protect the financial future of countless families through its life insurance offerings.

5. PHP Agency

PHP Agency, short for People Helping People, is a USA-based financial services MLM company founded in 2009. The company offers life insurance, annuities, and other financial products, with a mission to empower individuals from diverse backgrounds to achieve financial success.

Achievements:

- Revenue for 2023: $300 million

- PHP Agency has experienced rapid growth, particularly in the multicultural market, and has built a large, diverse team of agents.

- The company was featured in the Inc. 5000 list as one of the fastest-growing private companies in America.

- PHP Agency is known for its vibrant company culture and commitment to developing the leadership skills of its agents.

6. Novae

Novae, founded in 1995 and based in the USA, is a financial services MLM company offering a range of services, including credit repair, financial education, and identity theft protection. The company’s mission is to empower individuals to improve their financial well-being and protect their identities.

Achievements:

- Revenue for 2023: $20 million

- Novae has been recognized for its comprehensive financial education programs, which have helped many individuals improve their credit scores and financial literacy.

- The company has grown its network of representatives across the USA, focusing on underserved communities.

- Novae has expanded its product offerings to include additional services like financial planning and investment advice.

7. Trinti Communications

Trinti Communications is a US-based MLM insurance company founded in 2003. The company provides telecommunications services, including VoIP (Voice over Internet Protocol) solutions, targeting both residential and business customers.

Achievements:

- Revenue for 2023: $17 million

- Trinti Communications has established itself as a reliable provider of affordable telecom services, particularly in the VoIP market.

- The company has expanded its services to include various communication solutions, catering to a diverse customer base.

- Trinti Communications has built a strong network of independent agents who promote and sell its telecom services.

8. VIV

VIV, founded in 2018 and based in the USA, is a relatively new MLM insurance company offering home automation and energy management solutions. The company aims to provide smart technology that enhances home comfort and energy efficiency.

Achievements:

- Revenue for 2023: $5 million

- VIV has quickly gained recognition for its innovative products, particularly in the home automation space.

- The company has attracted a growing network of agents passionate about promoting eco-friendly and smart home solutions.

- VIV has been featured in several technology and business publications for its unique approach to combining MLM with cutting-edge technology.

9. Pro Financial Group

Pro Financial Group, founded in 1977 in the USA, is an MLM company that offers a range of financial services, including life insurance, annuities, and investment products. The company focuses on helping clients achieve long-term financial security through personalized financial planning.

Achievements:

- Revenue for 2023: $4 million

- Pro Financial Group has built a reputation for providing high-quality financial services and personalized client care.

- The company has maintained a stable presence in the financial services industry for decades, offering consistent value to its clients.

- Pro Financial Group is known for its commitment to ethical business practices and its focus on long-term financial planning.

List of top MLM insurance companies 2026

| Sl No. | Company | Country | Revenue (2023) | Revenue (2022) | Year Founded |

|---|---|---|---|---|---|

| 1 | Utility Warehouse – Telecom Plus | UK | 2.990 B | 2.03 B | 2002 |

| 2 | Primerica | USA | 2.816 B | 2.72 B | 1977 |

| 3 | World FInancial Group | USA | 1.3B | 1.2B | 2001 |

| 4 | Family First Life | USA | 503M | 300M | 2013 |

| 5 | PHP Agency | USA | 300M | 200M | 2009 |

| 6 | Novae | USA | 20M | 20M | 1995 |

| 7 | Trinti Communications | USA | 17M | 17M | 2003 |

| 8 | VIV | USA | 5M | 5M | 2018 |

| 9 | Pro Financial Group | USA | 4M | 4M | 1977 |

Commission Structures in MLM Insurance Companies

In the world of MLM insurance companies, agents earn commissions not only from their own direct sales but also from the sales made by their recruits.Effective commission management is crucial in ensuring that agents are fairly compensated and motivated to grow their downline.

MLM insurance companies have different ways for agents to earn money:

Direct Sales Commission:

Agents earn a share of the premiums from clients they sign up directly. This rewards agents for their personal sales efforts.

Override Commission:

Agents make money from the sales made by agents they’ve brought into the company. This encourages agents to recruit and mentor others.

Residual Commission:

Agents get ongoing payments as long as their clients keep paying their premiums. This provides a steady income stream for maintaining client relationships.

Comparison of Different Commission Structures

Here’s a comparison of different commission structures:

Flat Commission Rate:

A set percentage of each sale, which is simple but might not motivate agents to excel. It offers consistency but lacks the drive for higher sales.

Tiered Commission Structure:

Higher commissions are offered for greater sales, motivating agents to increase their sales volume. This structure rewards top performers more substantially.

Hybrid Commission Structure:

Blends flat and tiered rates, giving agents a balanced incentive for both their individual sales and their team’s performance. It aims to motivate personal effort while also fostering team growth.

Pros and Cons of MLM Commission Systems

Pros

- High Earning Potential: Commissions can be significant, particularly with a large network of clients. This offers the possibility of substantial financial rewards.

- Motivational Structure: Encourages both personal sales and team recruitment, driving performance. This creates a dynamic environment where effort is rewarded.

- Residual Income: Offers ongoing earnings from existing clients, providing a steady income stream. This can lead to long-term financial stability.

- Scalability: The business model allows for growth as agents expand their networks and teams, potentially increasing their earnings over time.

Cons

- High Emphasis on Recruitment: Heavy focus on recruiting can raise ethical issues and lead to concerns about pyramid schemes. This can sometimes overshadow the importance of selling actual products.

- Income Variability: Earnings can be unpredictable, especially for new agents. This can make financial planning difficult.

- Complex Structures: Commission systems can be intricate, making it challenging for new agents to grasp their potential earnings. This can lead to confusion and frustration.

- High Turnover Rate: The demanding nature of the business and income variability can result in high turnover rates among agents, impacting team stability.

Benefits of Joining MLM Insurance Companies

Flexibility and Independence for Agents

MLM insurance companies offer agents a high degree of flexibility and independence. Agents can set their own schedules, work from various locations, and grow their business at their own pace. This flexibility is a significant attraction for those looking to balance work with other life commitments.

Potential for High Earnings

The insurance MLM model provides agents with the potential for high earnings through a combination of direct sales commissions and team-building. As agents expand their downline and mentor new recruits, their income can grow exponentially, offering substantial financial rewards over time.

Variety of Insurance Products from Multiple Carriers

One of the key advantages of working with MLM insurance companies is the access to a wide variety of insurance products from multiple carriers. This diversity allows agents to meet the specific needs of their clients, offering tailored solutions that enhance customer satisfaction and increase sales success within the insurance MLM framework.

Challenges and Criticisms of MLM Insurance Companies

High Emphasis on Recruitment

A common criticism of MLM insurance companies is the heavy emphasis on recruitment over product sales. While team-building is essential in MLM insurance, some companies place such a strong focus on recruitment that it can overshadow the core business of selling insurance products.

Ethical Concerns and Potential for Pyramid Scheme Accusations

The structure of insurance MLM can sometimes resemble that of a pyramid scheme, particularly if the focus is more on recruiting new members than on selling legitimate insurance products. This can lead to ethical concerns and legal scrutiny, making it crucial for MLM insurance companies to operate transparently and prioritize product quality.

Variability in Product Quality and Transparency Issues

Not all products offered through MLM insurance companies are of equal quality, and there can be inconsistencies in transparency regarding the terms and conditions. This variability can lead to customer dissatisfaction and negatively impact the reputation of both the agents and the insurance MLM companies they represent.

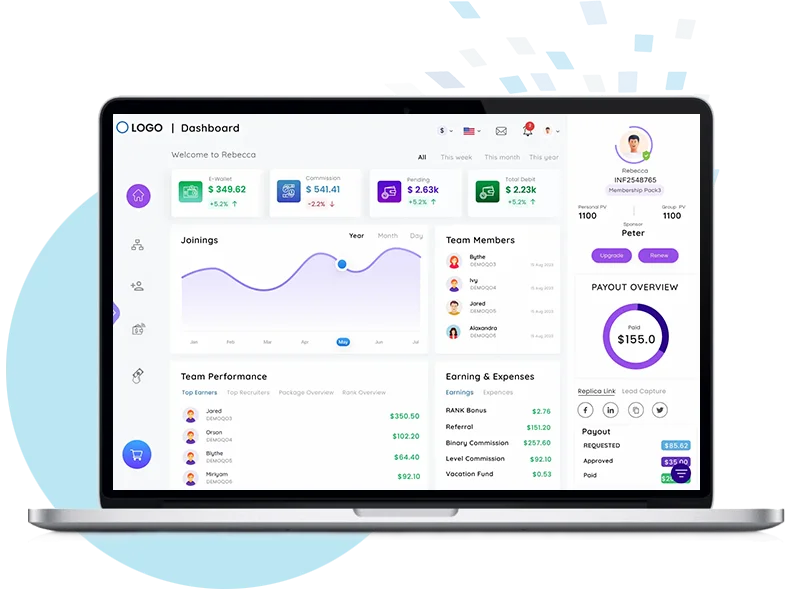

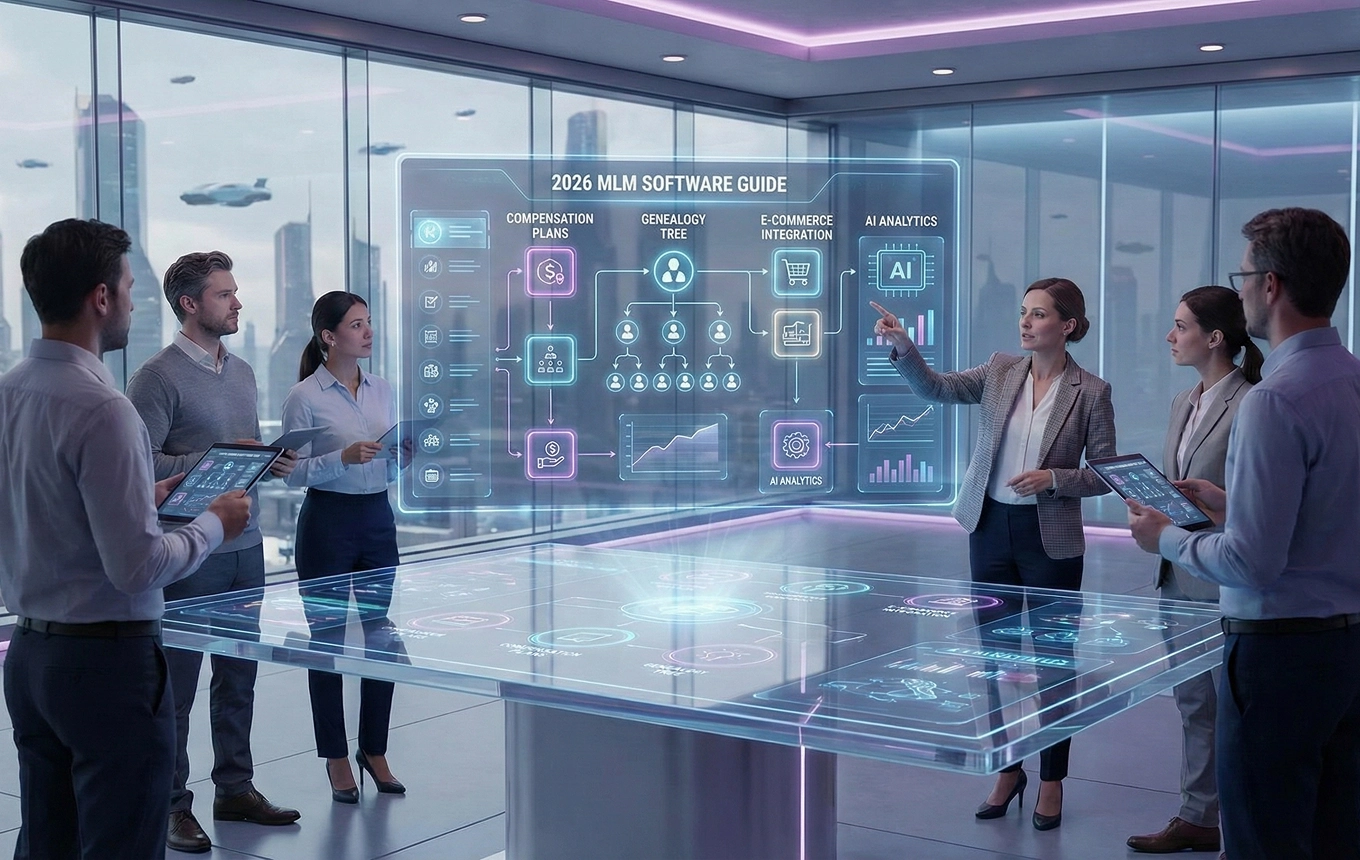

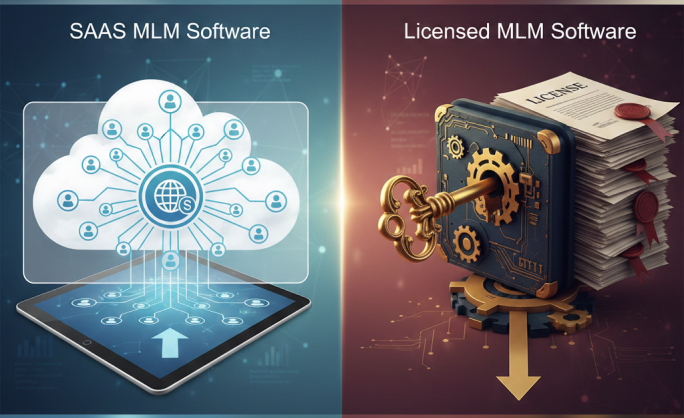

MLM Software for Insurance companies

MLM software for insurance companies is designed to simplify and enhance multi-level marketing operations. It simplifies complex processes and improves efficiency across the board. Key features typically include:

1. Agent Management:

Monitors and oversees the performance of agents at various levels, tracking their sales, recruits, and earnings.

2. Commission Tracking:

Automates commission calculation and distribution of commissions, accommodating different commission structures (e.g., flat, tiered, hybrid).

3. Sales Reporting:

Generates detailed reports on sales activities, allowing companies to analyze performance and adjust strategies.

4. Recruitment Tools:

Simplifies the process of recruiting and onboarding new agents, making it easier for both the company and new hires.

5. Training and Support:

Provides resources and training materials to help agents improve their skills and understand the MLM system.

6. Compliance Monitoring:

Ensures that MLM practices comply with local and international regulatory standards, helping to avoid legal issues.

7. Customer Relationship Management (CRM):

CRM Manages client interactions and tracks customer data to improve service and retention.

By integrating MLM software features will helps insurance companies effectively manage their MLM programs, support their agents, and drive overall business growth. Additionally, it supports scalability, enabling companies to adapt to increasing demands and expand their network efficiently.

Conclusion

MLM insurance companies offer a unique blend of financial services and entrepreneurial opportunity. For agents, the benefits include flexibility, independence, and the potential for high earnings through both sales and recruitment within the insurance MLM framework.However, these advantages come with challenges, including navigating complex commission structures, maintaining ethical practices, selecting the right MLM software by seeking out reviews and testimonials from current and former distributors and ensuring the quality and transparency of the products offered. For those willing to invest the time and effort, achieving MLM success in an insurance company can be significant, offering a fulfilling career that combines financial success with the satisfaction of helping others secure their futures.